What I Told Jerome Powell: Don’t Cut Rates

What I Told Jerome Powell: Don’t Cut Rates

by David Stockman at Brownstone Institute

We recently chanced to importune our Fed Chairman at a cocktail party in NYC. Our message to Jay Powell was that there are multiple reasons to stop cutting interest rates, but in light of the current government shutdown, one of the most compelling arguments is that the Fed’s cheap money policies have essentially destroyed any semblance of fiscal discipline in America.

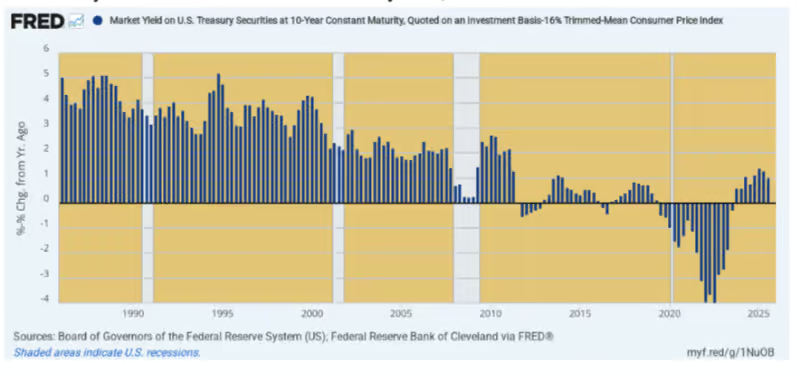

Specifically, we reminded him that real rates on the ballooning Federal debt have been essentially zero or negative for most of the time since the so-called Great Financial Crisis. In turn, this means that the current generation of elected politicians in Washington has been drastically misled—euthanized as it were—as to the true cost of massive and chronic budget deficits.

Here is the inflation-adjusted yield on Uncle Sam’s benchmark security, the workhorse 10-year Treasury Note. In fact, the inflation-adjusted yield has averaged -0.30% during the entirety of the span from 2011 thru 2025 to date. Even now it stands at only +1.0%.

So, we suggested to Powell that the Fed is falsely telling the elected politicians that the swelling total of government debt is cost-free. Of course, Chairman Powell did not blink, saying that as it may, “We focus only on what’s best for the economy.”

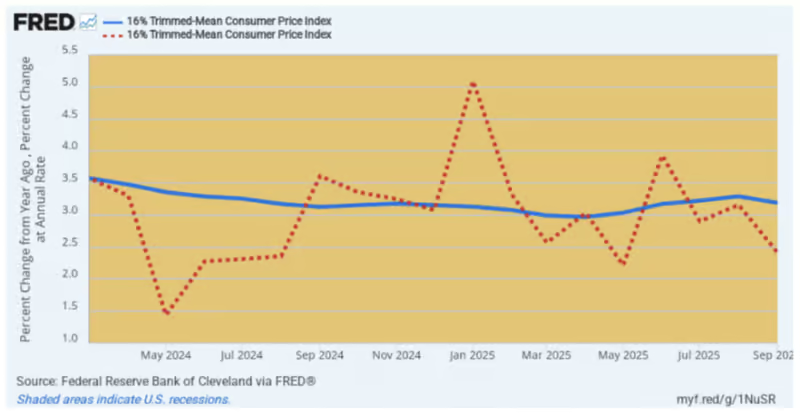

Again today, therefore, what’s putatively best for the economy according to Jay Powell and his merry band of money-printers is yet another 25-basis point rate cut, with a hint of more to come. That is to say, the Fed appears on track to push the real interest rate back below the zero bound because there is no evidence at all that the running inflation rate has dropped below 3.00%, and, as we have previously noted, it seems to be actually accelerating since April.

In that regard, we offer our trusty 16% trimmed mean CPI. For the last year the annualized rate of monthly change has been oscillating in the +2% to +4% range, and now the slower moving Y/Y rate has turned higher as well, posting at 3.2% in September. Needless to say, how more of this stiff level of inflation is good for the Main Street economy the Fed chairman didn’t say—even as self-evidently his continued rate-cutting is signalling the spenders of Washington and the unhinged speculators in the canyons of Wall Street to keep on keeping on.

Then again, were the Fed to keep trucking along the path of the graph’s blue line for the next decade, the purchasing power of a dollar earned or saved today would be just 72 cents at the end. How that would incentivize the classic ingredients of supply-side vigor—savings, investment, risk-taking, work effort, and business enterprise—he didn’t say, either. And for an obvious reason: Read today’s post-meeting statement or any of the cloned variations for the last multitude of months and years and you will find no reference to the supply side or Say’s Law, at all.

To the contrary, the Fed is all about Keynesian demand management, as if the US economy were the equivalent of some giant bathtub: Its job is to flush it full to the rim with “aggregate demand” by continuously falsifying interest rates whenever there is a hint of deficient spending.

But, of course, that whole proposition is rooted in the nonsense published by Professor J.M. Keynes during the wholly different circumstances of the 1930s.

Even then, the 1930s did not repeal Say’s Law or repudiate in any way its axiom that supply generates its own demand. The 1930s Great Depression, in fact, was just the morning-after liquidation of the massive buildup of debt and excess export capacity that had materialized during the Great War and during the 1920s foreign bond bubble. In turn, both the war economy boom and the 1920s export boom were owing to the unsustainable credit expansion that had been fueled by the exuberant pace of money-printing at the nation’s newborn central bank.

In any event, the first graph above is the smoking gun. During the 1985 to 2000 period, the inflation-adjusted 10-year bond yield averaged +380 basis points, but that did not slow down the real Main Street economy in any way. Real economic growth as measured by the real final sales of domestic product averaged 3.65% per annum over the 15-year period.

By contrast, since the Eccles Building money-printers jumped the shark during and after the Great Recession there has been no cigar whatsoever. Despite the aforementioned -0.3% average in the real bond yield after 2010, real growth has averaged just 1.89% per annum since the pre-crisis peak in Q4 2007.

So contrary to Jay Powell, we’d say that marching real interest rates back into the economic netherworld of negative yields is not “what’s good for the economy” at all. The only thing that another round of cheap credit is actually good for is to accommodate the worst impulses of the spenders in the Beltway and the speculators on Wall Street.

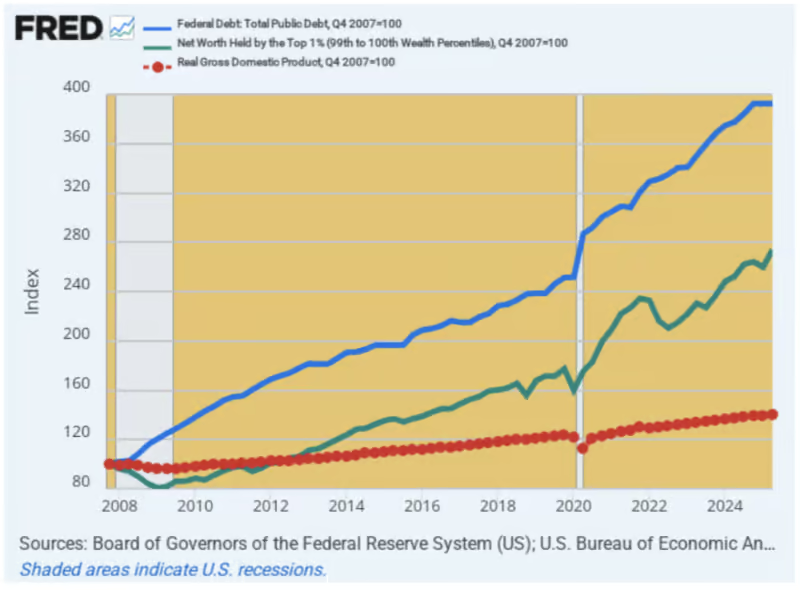

Not surprisingly, therefore, even as the real GDP (red line) has risen by just 40% since Q4 2007, the Federal debt (blue line) is up by 300% and the net worth of the top 1% of households (green line) has risen by 175%. So next time we see Powell we will remind him that, yes, easy money is very good for the spenders and speculators on either end of the Acela Corridor. But as to the Main Street economy—not so much!

Reposted from Stockman’s private site

What I Told Jerome Powell: Don’t Cut Rates

by David Stockman at Brownstone Institute – Daily Economics, Policy, Public Health, Society

The post What I Told Jerome Powell: Don’t Cut Rates was first published by The Brownstone Institute, and is republished under a Creative Commons Attribution 4.0 International License. Please support their efforts.